Payroll compliance means ensuring that employee salaries, tax deductions, and benefits are processed according to government laws and labor regulations. It protects businesses from penalties, ensures employee trust, and creates financial stability. For companies of all sizes, payroll compliance is not only a legal obligation but also a critical factor in building a strong, sustainable business.

Payroll compliance refers to the process of managing employee payments in line with laws and regulations. It includes:

Accurate salary and overtime calculations

Deduction of taxes and social contributions

Compliance with labor laws and minimum wage standards

Timely submission of tax filings and reports

Secure recordkeeping for audits and inspections

In simple words: Payroll compliance ensures employees are paid fairly and businesses follow the law.

Non-compliance can lead to fines, lawsuits, and audits. Following regulations ensures your business remains legally protected.

Employees rely on accurate and timely payment. Compliance shows professionalism and strengthens employee loyalty.

Mistakes in payroll may cause unexpected expenses. Compliance creates predictable, stable financial operations.

Businesses that comply with laws gain a reputation for responsibility, while non-compliance can damage credibility.

Standardized payroll compliance reduces errors and saves time, allowing HR teams to focus on strategy rather than manual corrections.

Many businesses face payroll compliance difficulties due to:

Frequent Tax Law Changes – Constant updates make it hard to stay compliant.

Manual Processing Errors – Human mistakes in overtime or deductions cause risks.

Multiple Locations – Different regions may have unique labor regulations.

Employee Classification – Mislabeling workers as contractors can lead to legal issues.

Data Privacy – Payroll involves sensitive information, requiring strict confidentiality.

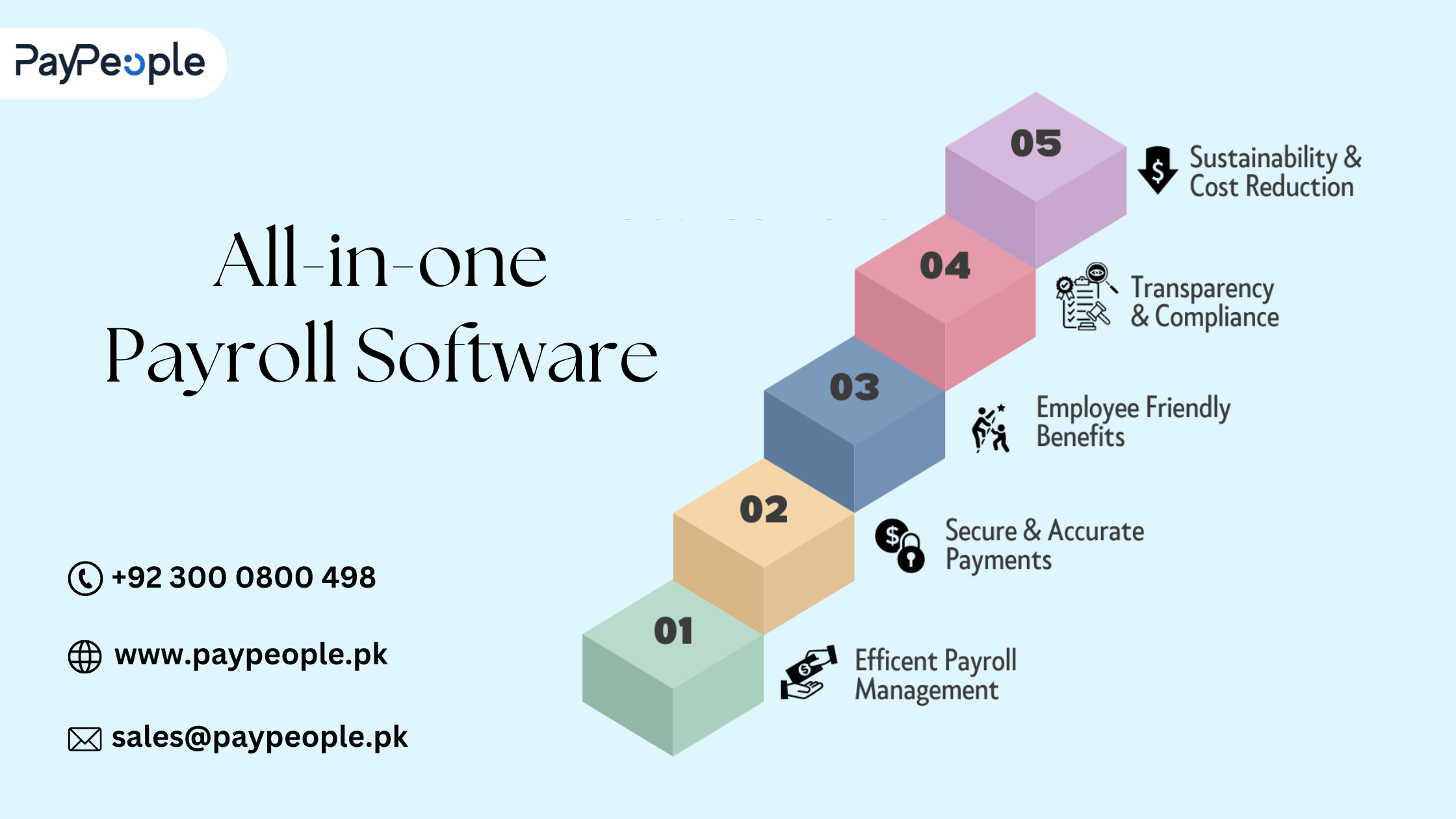

Modern payroll software solves compliance challenges by offering:

Reduces manual errors and ensures accurate deductions.

Automatically adjusts to new government tax laws.

Keeps contracts, payslips, and compliance reports in one secure platform.

Employees can access payslips, tax forms, and leave records without HR intervention.

Generates audit-ready reports that make inspections faster and smoother.

Protects sensitive payroll information with encryption and access control.

Attracts Talent – Fair and transparent payroll boosts employer reputation.

Retains Employees – Trustworthy payment processes keep employees satisfied.

Builds Investor Confidence – Investors prefer compliant businesses.

Supports Expansion – Compliance ensures smooth scaling across locations.

Q1: What is the risk of ignoring payroll compliance?

Businesses risk fines, audits, and legal actions if they fail to comply with payroll regulations.

Q2: How does payroll software reduce compliance risks?

It automates calculations, updates tax laws, and generates compliance reports, ensuring accuracy and timeliness.

Q3: Is payroll compliance important for small businesses?

Yes. Even small businesses must follow labor and tax laws to avoid penalties.

Q4: Can outsourcing payroll improve compliance?

Yes, but businesses must check the provider’s reliability and ensure data security.

Q5: What is the role of HR in payroll compliance?

HR ensures accurate classification, benefits management, and coordination with finance to maintain compliance.

Payroll compliance is more than a legal requirement; it is a business strategy that protects companies from risks, builds employee trust, and ensures long-term sustainability. By adopting modern payroll software, such as PayPeople Payroll Software, organizations can automate compliance, enhance efficiency, and bolster their reputation.

You can also read our other blogs, like: