Run Payroll Effortlessly with PayPeople! Compliance is fully automated

PayPeople Payroll Software in Pakistan automatically manages all your compliance requirements with local and federal authorities. You can avoid the tedious work—everything is handled seamlessly for you.

PROVIDENT FUND COMPLIANCE

Effortless PF Calculations with Automatic Filing—Simplify Your Payroll!

Whether by management bands or employee wage ranges, PayPeople Payroll Software in Pakistan lets you set up provident fund rules effortlessly. Include it in the CTC or keep it separate—we handle your calculations. After payroll, we’ll even generate the electronic file format automatically!

ESI COMPLIANCE

Streamline ESI Setup and Calculations with PayPeople Payroll and HR Software!

Easily configure ESI application and computation for both full-time and hourly employees. PayPeople HR Software in Pakistan automatically generates compliant filing outputs that meet ESI office standards, ensuring effortless accuracy every time!

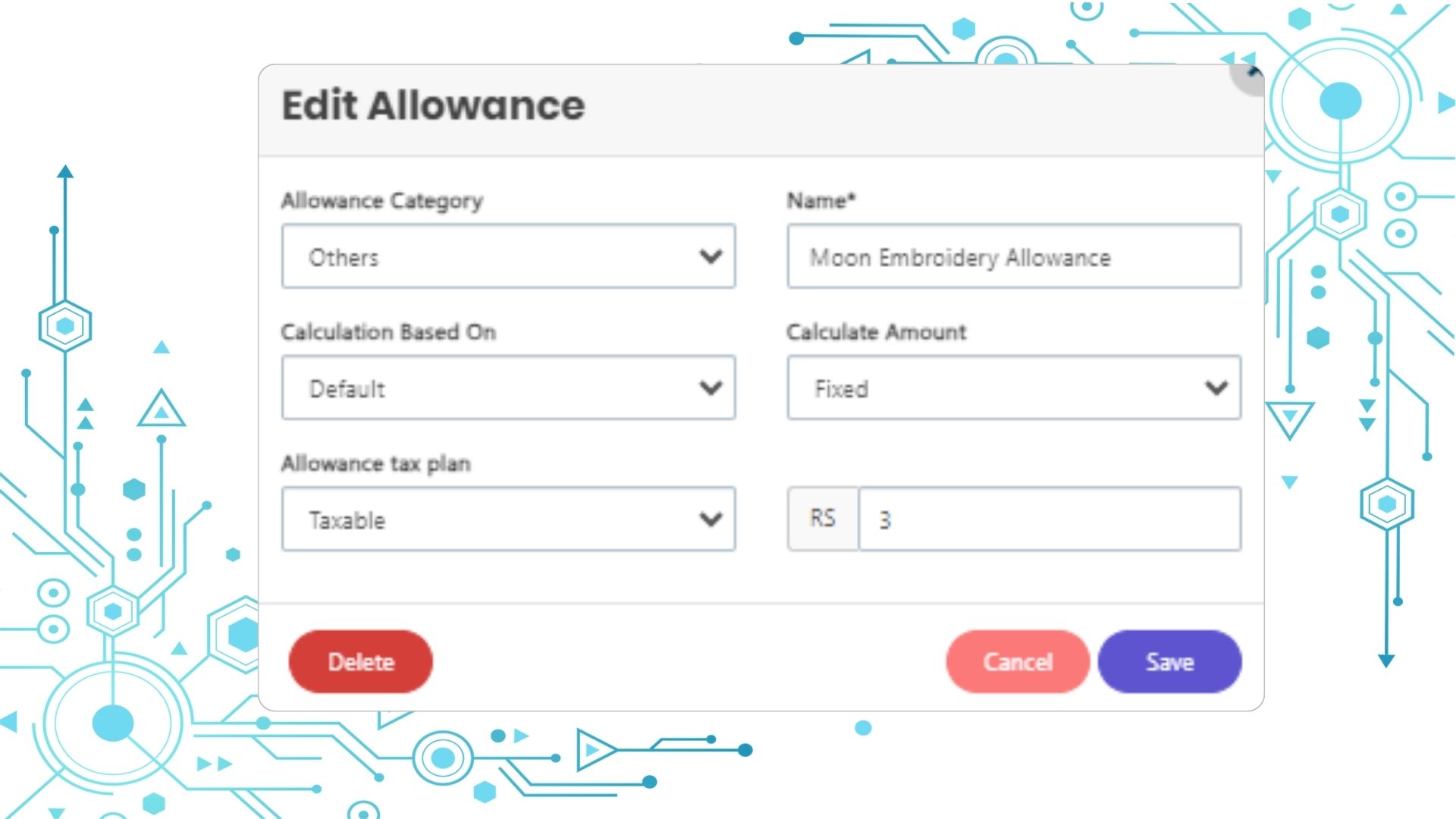

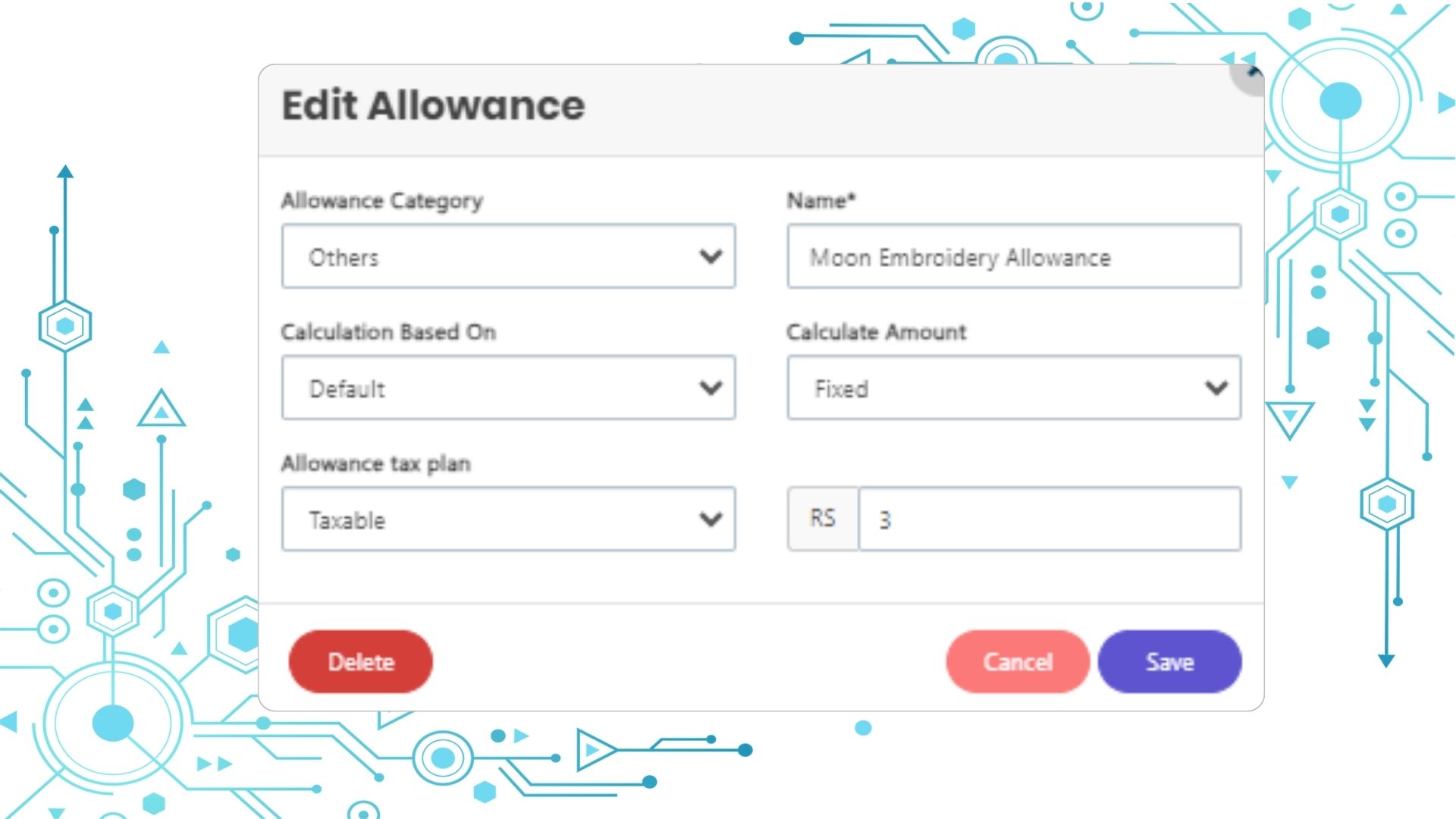

LEGISLATIVE TAX COMPLIANCE

Professional Tax Tailored to Your State’s Specific Rules

Each state has unique professional tax rules and compliance requirements. PayPeople simplifies it all by automatically deducting professional tax and preparing the necessary compliance paperwork for each state. You can also customize the rules to handle complex cases with ease!

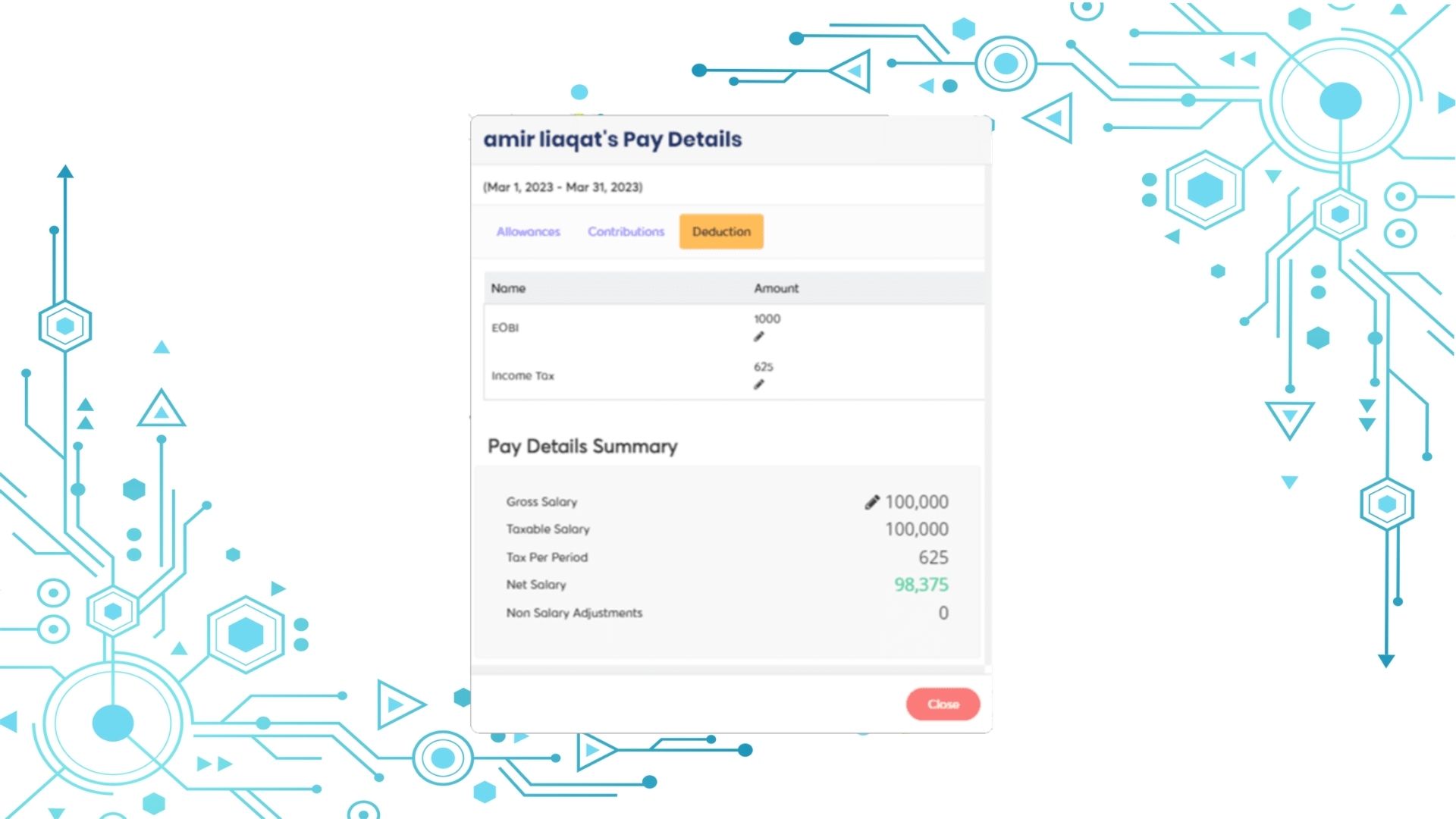

INCOME TAX COMPLIANCE

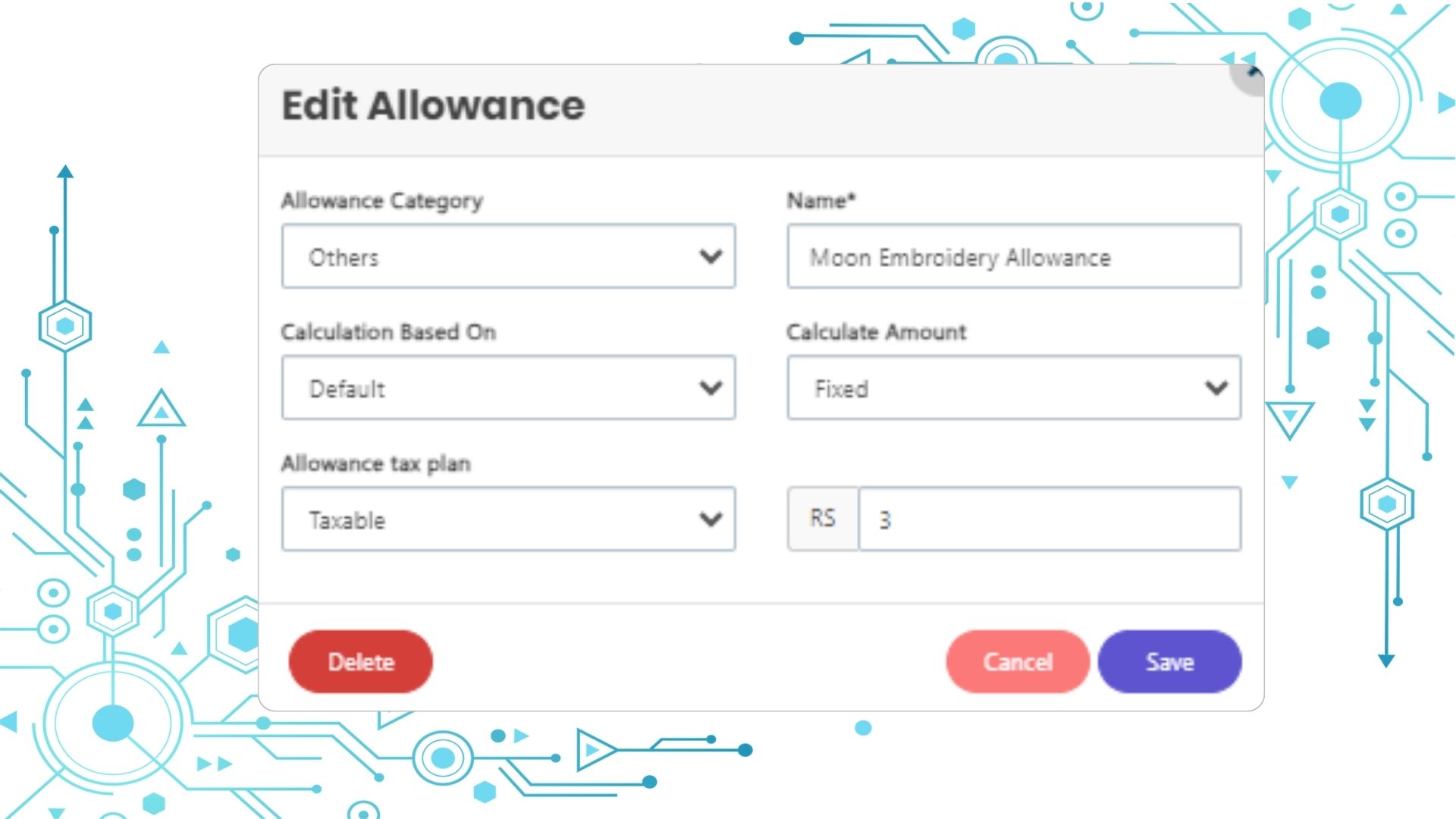

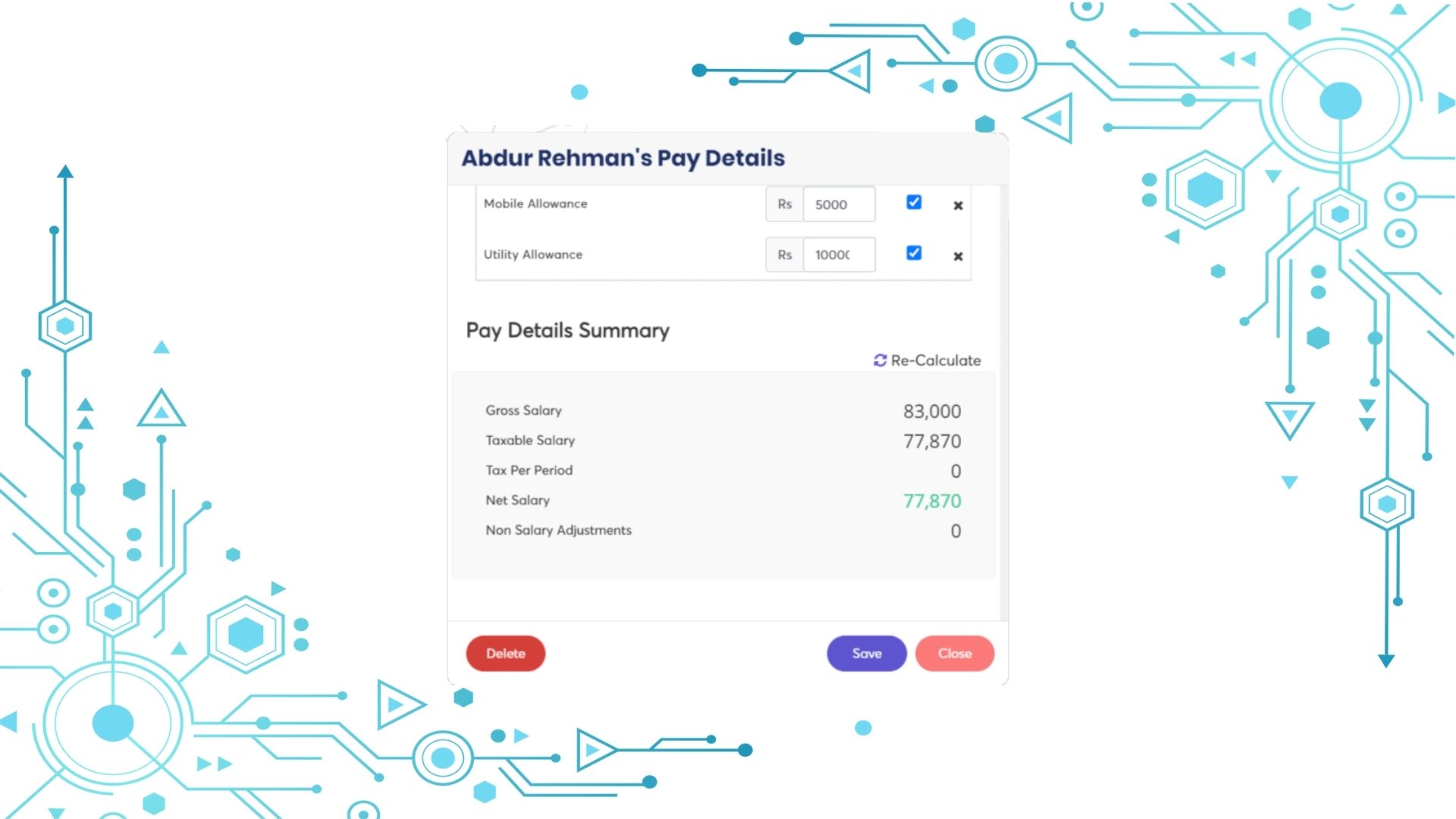

Comprehensive TDS (IT) Computations with Seamless eTDS Returns

PayPeople breaks down your allowances and deductions as per IT department requirements and generates TDS filing statements and challans for easy electronic submission.

FILINGS FOR INCOME TAX DEDUCTIONS

Effortless FVU Validation and One-Click Form 24Q Generation

Per IT department requirements, you need to submit returns every quarter in the specified electronic format. With PayPeople HR Analytics Software in Pakistan, the entire process is automated, saving you time and effort.

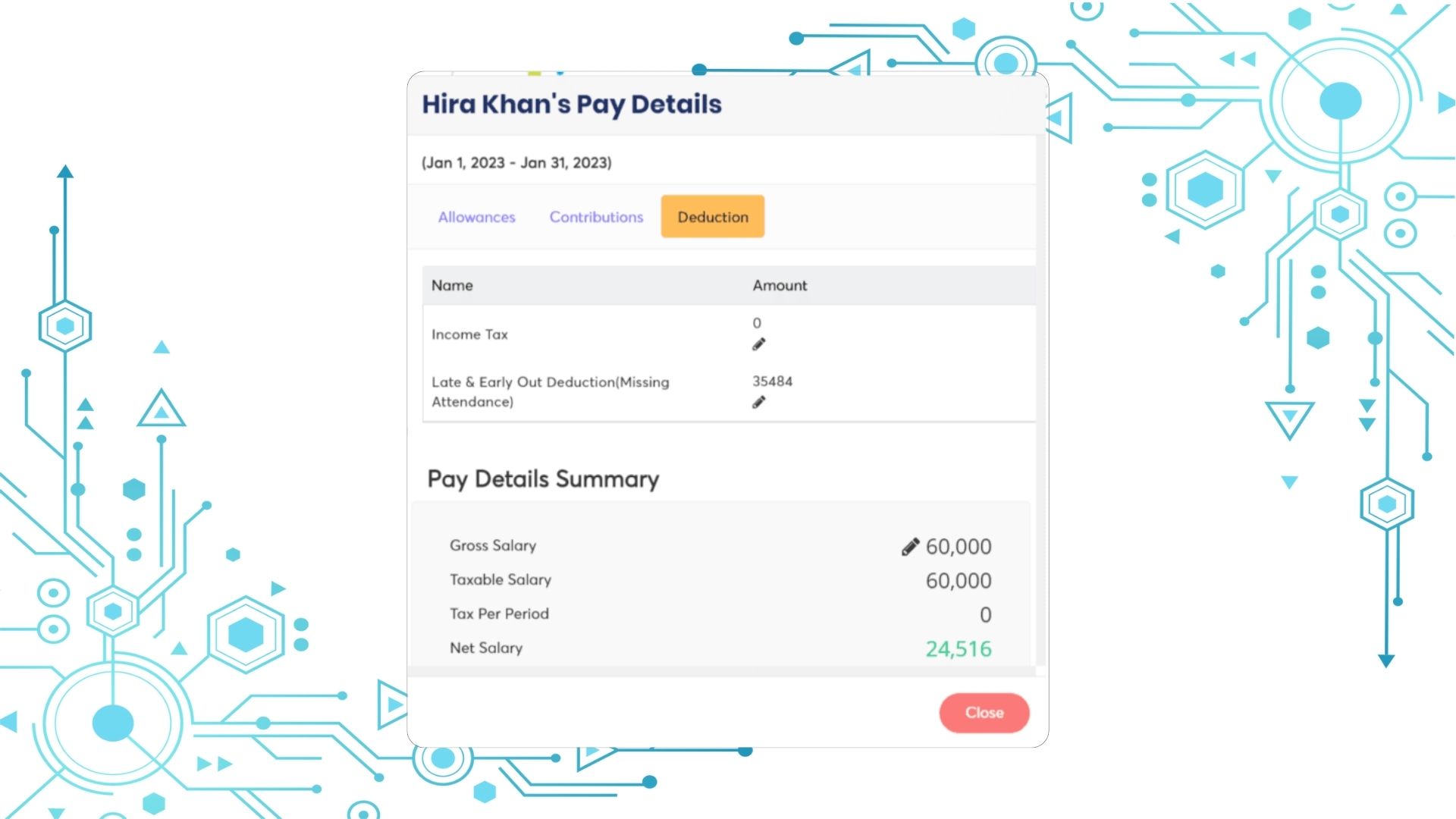

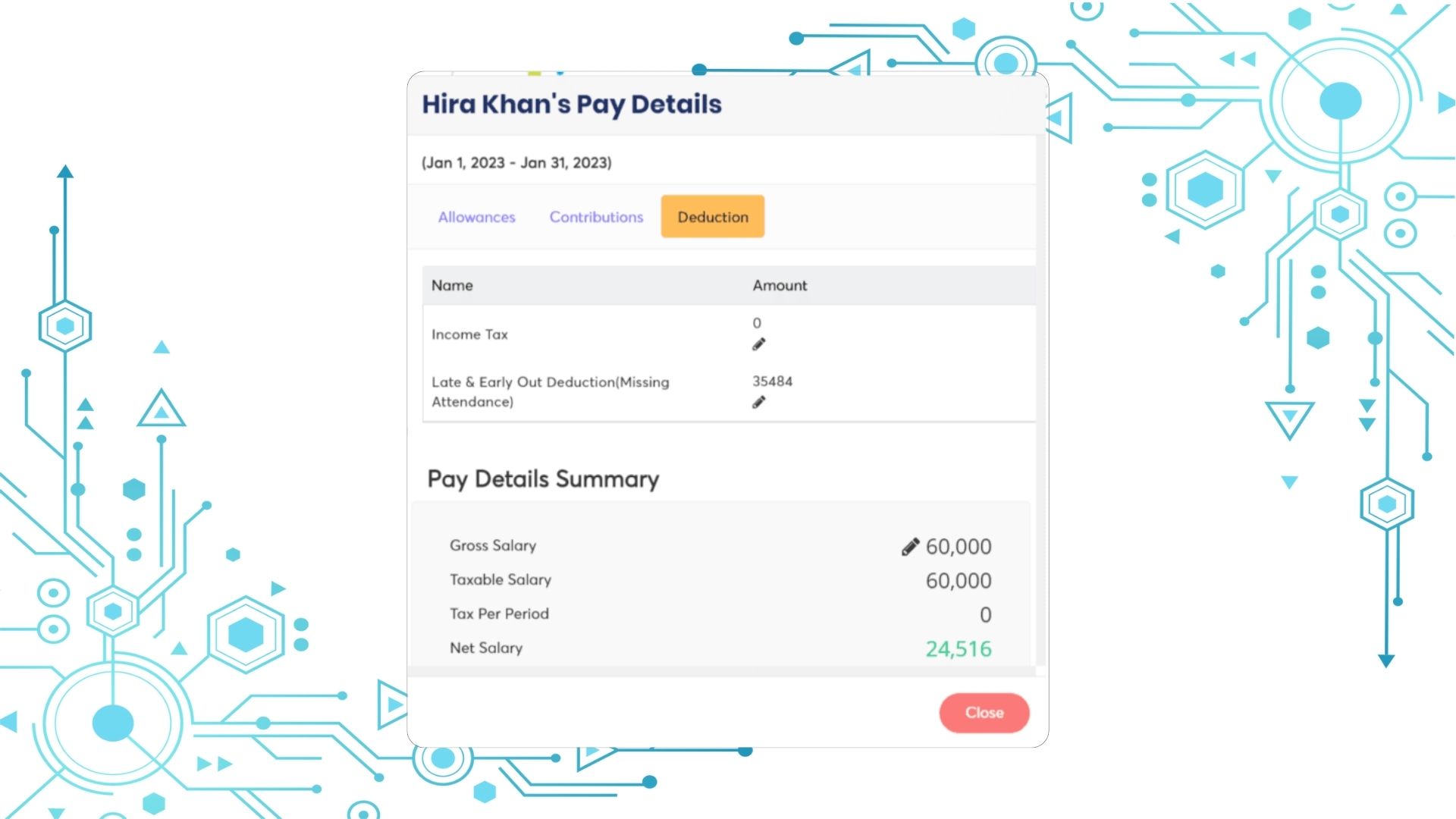

TAX DEDUCTION ADJUSTMENTS

Prorated Tax Deductions for Wage Adjustments, Bonuses, and Declarations—Simplified!

At PayPeople, we ensure your tax deductions are precise throughout the fiscal year, even with salary adjustments, bonuses, leave encashments, or lost wages. You’ll enjoy the highest possible take-home pay while staying fully compliant with tax laws. Let us handle the complexities, so you can focus on what matters most!

FUND FOR LABOR WELFARE

Comprehensive LWF Contribution Coverage Across All States

In states where Labour Welfare Fund (LWF) contributions are mandatory, PayPeople simplifies the process by automatically calculating contributions and handling filing requirements, tailored to each state’s unique regulations.