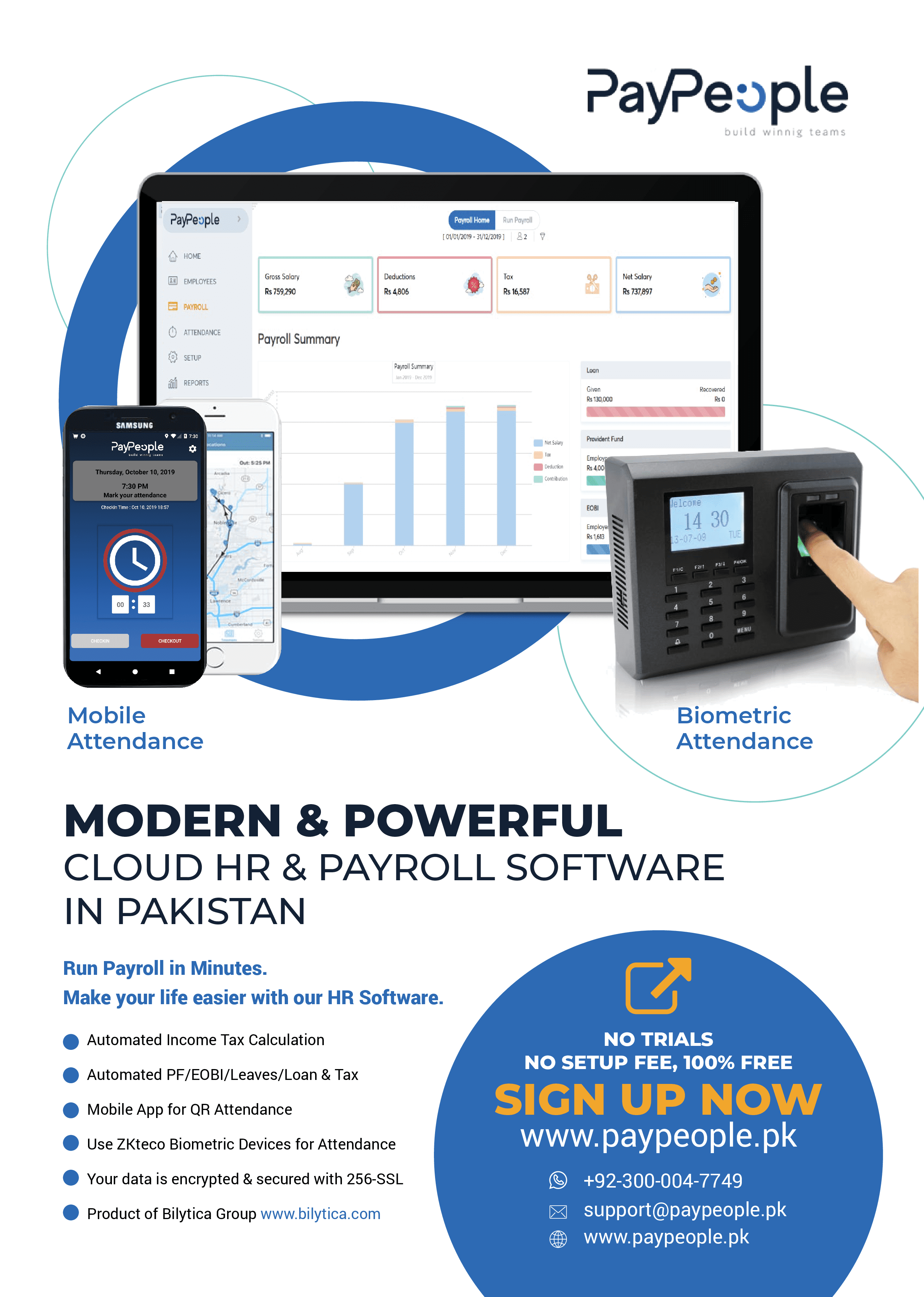

Paypeople #1 Attendance Software in Karachi Biometric technology was once introduced to give a boost to safety and enhance productivity. Today, biometric units and time attendance machines are employed considerably for client verification and to track employees’ attendance in a number of banks and financial institutes globally.

Click to Start Whatsapp Chat with Sales

Call #:+923000507555

Email: sales@bilytica.com

Paypeople #1 Attendance Software in Karachi

The time Attendance Software in Karachi acts as a strong identification verification tool and exactly tracks the attendance of the employees.

Challenges in the BSFI Sector

When it comes to identifying an individual, the banking and financial service industry (BSFI) is facing a myriad of problems. According to Statista, there have been 6800 notified incidences of banking fraud cases throughout Pakistan.

Major Problems faced through the BSFI businesses include:

- Using Attendance Software in Karachi Identity theft.

- Credit card cloning.

- Data security.

- Customer onboarding (KYC).

- Privacy protection.

- Customer authentication/verification.

- Internal identity-based threats.

How Does Biometric System Solve These Problems?

As we are moving toward digitalization, giving a reliable, secure, and friction-free client experience is getting more necessary than ever. Here are a few methods the biometric system solve the issues mentioned above and revolutionize the BFSI sector.

Know Your Customer (KYC)

KYC rules are aimed at stopping cash laundering. After the Government made the Aadhaar mandatory, extra and more banks are deploying biometric identity verification solutions and are asking for Aadhaar cards. Fingerprints give a dependable way to identify a client towards a pre-existing database.

Enhanced Customer Experience

HRMS in Islamabad Instead of remembering passwords or pins, clients can now confirm themselves through fingerprints, iris, and different special human traits. This now not only eliminates the want to keep in mind otherwise strong passwords but additionally provides improved security. Also, biometrics these days are a good deal faster.

Concrete Audit Trails

Apart from improving safety and enhancing the client experience, biometric systems assist the banking systems to efficiently and exactly carry out audit trails of transactions.

Employee Authentication

As mentioned above, the time Attendance Software in Karachi is now not only for customers, however, it is additionally for the employees. Many banks are changing passwords at worker terminals to improve identification and access management. This helps banks remove internal identity-based threats.

IDFC and SBI have been the first to introduce biometric sensors in the Pakistann banking enterprise for dependable transfer of payment involving smartphones. And now, the biometric HR Software in Islamabad is broadly adopted in the country.

we also provide the Zkteco thumb attendance machine or device which is also known as Zkteco face attendance machines or devices. We provide services to implement Zkteco biometric devices and machines with the support of the following models. Zkteco IN05 & IN05-A is a good device but Zkteco SilkBio100-TC is also good attendance biometric device machine better than Zkteco IN01 & IN01-A and Zkteco MB10 with Zkteco MB20 along with Zkteco IN02-A

along with better support biometric Zkteco K20 which has good compatibility Zkteco K40 and Zkteco K60 for long term warranty Zkteco WL20. We also provide support of Zkteco uFace202 which is the best face recognition device by Zkteco. Zkteco K30 and Zkteco UFace800 are the best face attendance machines along with Zkteco BioTime 8.0.4 and Zkteco uFace602. Zkteco provides the best attendance device and machines for Zkteco iClock880 and Zkteco UA400. We strongly recommend checking Zkteco MiniTA and Zkteco uFace202 Plus for Face and Voice facial recognition access control software systems and machines. Zkteco uFace302 Plus and Zkteco uFace401 Plus are the best attendance machines along with face attendance features for Zkteco uFace402 Plus and Zkteco uFace602 Plus. Zkteco uFace800 Plus is by far the best face biometric attendance machine better than Zkteco ZPad Plus and Zkteco MB40-VL with the great support of Zkteco ZPad Plus(4G). We provide great support for Zkteco K50-A and Zkteco EFace 10.

Attendance and leave management along with access control with Zkteco MB360 and Zkteco WL10 is a good experience for management of payroll and leave management. Zkteco claims that their device models price of Zkteco WL30, Zkteco UA300, Zkteco UA760, Zkteco UA860, and Zkteco iClock680 is cheaper than Zkteco iClock700, Zkteco P160, Zkteco P200 & P260, Zkteco MB160, and Zkteco MB460. We also provide support for Zkteco SFace900 price in and price for Zkteco uFace302 and Zkteco uFace800 along with Zkteco S922 which provides better facial authentication and recognition with Zkteco WDMS Zkteco ZKTime.Net 3.3

Click to Start Whatsapp Chat with Sales

Call #:+923000507555

Email: sales@bilytica.com

Attendance Software in Karachi

Attendance Software in Karachi

Attendance Software in Karachi

Attendance Software in Karachi

We are one of the best Top Attendance Software in Karachi Revolutionizing the Financial Sector Price in Pakistan in Azad Kashmir, Bagh, Bhimber, khuiratta, Kotli, Mangla, Mirpur, Muzaffarabad, Plandri, Rawalakot, Punch, Balochistan, Amir Chah, Bazdar, Bela, Bellpat, Bagh, Burj, Chagai, Chah Sandan, Chakku, Chaman, Chhatr, updated on 2025-07-19T07:54:45+05:00 Dalbandin, Dera BugtiBarcode Shop offer lowest Top Attendance Software in Karachi Revolutionizing the Financial Sector Price Face Recognition in cities Dhana Sar, Diwana, Duki, Dushi, Duzab, Gajar, Gandava, Garhi Khairo, Garruck, Ghazluna, Girdan, Gulistan, Gwadar, Gwash, Hab Chauki, Hameedabad, Harnai, Hinglaj, Hoshab, Ispikan, Jhal, Jhal Jhao, Jhatpat, Jiwani, Kalandi, Kalat, Kamararod, Kanak, Kandi, Kanpur, Kapip, KapparWe can deliver Face Recognition in Karodi, Katuri, Kharan, Khuzdar, Kikki, updated on 2025-07-19T07:54:45+05:00 Kohan, Kohlu, Korak, Lahri, Lasbela, Liari, Loralai, Mach, Mand, Manguchar, Mashki Chah, Maslti, Mastung, Mekhtar, Merui, Mianez, Murgha Kibzai, Musa Khel Bazar, Nagha Kalat, Nal, Naseerabad, Nauroz Kalat, Nur Gamma, Nushki, Nuttal, Ormara, Palantuk, Panjgur, Pasni, Piharak, Pishin, Qamruddin Karez, Qila Abdullah, Qila Ladgasht and this was updated on 2025-07-19T07:54:45+05:00 We also deal with Top Attendance Software in Karachi Revolutionizing the Financial Sector Price in Qila Safed, Qila Saifullah, Quetta, Rakhni, Robat Thana, Rodkhan, Saindak, Sanjawi, Saruna, Shabaz Kalat, Shahpur, Sharam Jogizai, Shingar, Shorap, Sibi, Sonmiani, Spezand, Spintangi, Sui, Suntsar, Surab, Thalo, Tump, Turbat, Umarao, pirMahal, Uthal, Vitakri, Wadh, Washap, Wasjuk, Yakmach, Zhob, Federally Administered Northern Areas/FANAWe are already sent Face Recognition to these places – Astor, updated on 2025-07-19T07:54:45+05:00 Baramula, Hunza, Gilgit, Nagar, Skardu, Shangrila, Shandur, Federally Administered Tribal Areas/FATA, Bajaur, Hangu, Malakand, Miram Shah, Mohmand, Khyber, Kurram, North Waziristan, South Waziristan, Wana, NWFP, Abbottabad, Ayubia, Adezai, Banda Daud Shah, Bannu, Batagram, Birote, Buner, Chakdara, Charsadda, Chitral, Dargai, Darya Khan, Dera Ismail Khan and this was updated on 2025-07-19T07:54:45+05:00 we are planning to open a branch office of in Drasan, Drosh, Hangu, Haripur, Kalam, Karak, Khanaspur, Kohat, Kohistan, Lakki Marwat, Latamber, Lower Dir, Madyan, Malakand, Mansehra, Mardan, updated on 2025-07-19T07:54:45+05:00 Mastuj, Mongora, Nowshera, Paharpur, Peshawar, Saidu Sharif, Shangla, Sakesar, Swabi, Swat, Tangi, Tank, Thall, Tordher, Upper Dir, Punjab, Ahmedpur East, Ahmed Nager Chatha, Ali Pur, Arifwala, Attock, Basti Malook, BhagalchurFace Recognition in Bhalwal, Bahawalnagar, Bahawalpur, Bhaipheru, Bhakkar, Burewala, Chailianwala, Chakwal, Chichawatni, Chiniot, Chowk Azam, Chowk Sarwar Shaheed, Daska, Darya Khan, Dera Ghazi Khan, Derawar Fort, updated on 2025-07-19T07:54:45+05:00 Dhaular, Dina City, Dinga, Dipalpur, Faisalabad, Fateh Jang, Gadar, Ghakhar MandiFace Recognition Top Attendance Software in Karachi Revolutionizing the Financial Sector Price s Demands very high in Gujranwala, Gujrat, Gujar Khan, Hafizabad, Haroonabad, Hasilpur, Haveli Lakha, Jampur, Jhang, Jhelum, Kalabagh, Karor Lal Esan, Kasur, Kamalia, Kamokey, Khanewal, Khanpur, Kharian, Khushab, Kot Addu, Jahania, Jalla Araain, Jauharabad, Laar, Lahore, Lalamusa, Layyah, Lodhran, Mamoori, Mandi Bahauddin, Makhdoom Aali, Mandi Warburton, Mailsi, Mian Channu, Minawala, Mianwali, Multan, Murree, Muridke, Muzaffargarh, Narowal, Okara, Renala Khurd, Rajan Pur, Pak Pattan, Panjgur and this was updated on 2025-07-19T07:54:45+05:00 and current Top Attendance Software in Karachi Revolutionizing the Financial Sector Price of is Rs 100 in Pattoki, Pirmahal, Qila Didar Singh, Rabwah, Raiwind, Rajan Pur, Rahim Yar Khan, Rawalpindi, Rohri, Sadiqabad, Safdar Abad – (Dhaban Singh), Sahiwal, Sangla Hill, Samberial, Sarai Alamgir, Sargodha, Shakargarh, Shafqat Shaheed Chowk, Sheikhupura, Sialkot, Sohawa, Sooianwala, Sundar (city), Talagang, Tarbela, Takhtbai, Taxila, Toba Tek Singh, Vehari, Wah Cantonment, Wazirabad and this was updated on 2025-07-19T07:54:45+05:00 Software solutions are widely available with Price updated on 2025-07-19T07:54:45+05:00 in Sindh, Ali Bandar, Baden, Chachro, Dadu, Digri, Diplo, Dokri, Gadra, Ghanian, Ghauspur, Ghotki, Hala, Hyderabad, Islamkot, Jacobabad, Jamesabad, Jamshoro, Janghar, Jati (Mughalbhin), Jhudo, Jungshahi, Kandiaro, Lahore, Kashmor, Keti Bandar, Khairpur, updated on 2025-07-19T07:54:45+05:00 Khora, Klupro, Khokhropur, Korangi, Kotri, Kot Sarae, Larkana, Lund, Mathi, Matiari, Mehar, Mirpur Batoro, Mirpur Khas, Mirpur Sakro, updated on 2025-07-19T07:54:45+05:00 Mithi, MithaniThe Barcode Shop deliver high quality Face Recognition in updated on 2025-07-19T07:54:45+05:00 Moro, Nagar Parkar, Naushara, Naudero, Noushero Feroz, Nawabshah, Nazimabad, Naokot, Pendoo, Pokran, Qambar, Qazi Ahmad, Ranipur, Ratodero, Rohri, Saidu Sharif, Sakrand, Sanghar, Shadadkhot, Shahbandar, Shahdadpur, Shahpur Chakar, Shikarpur, Sujawal, Sukkur, Tando Adam, Tando Allahyar, Tando Bago, Tar Ahamd Rind, Thatta, Tujal, Umarkot, Veirwaro, Warah and this was updated on 2025-07-19T07:54:45+05:00

24/02/2022